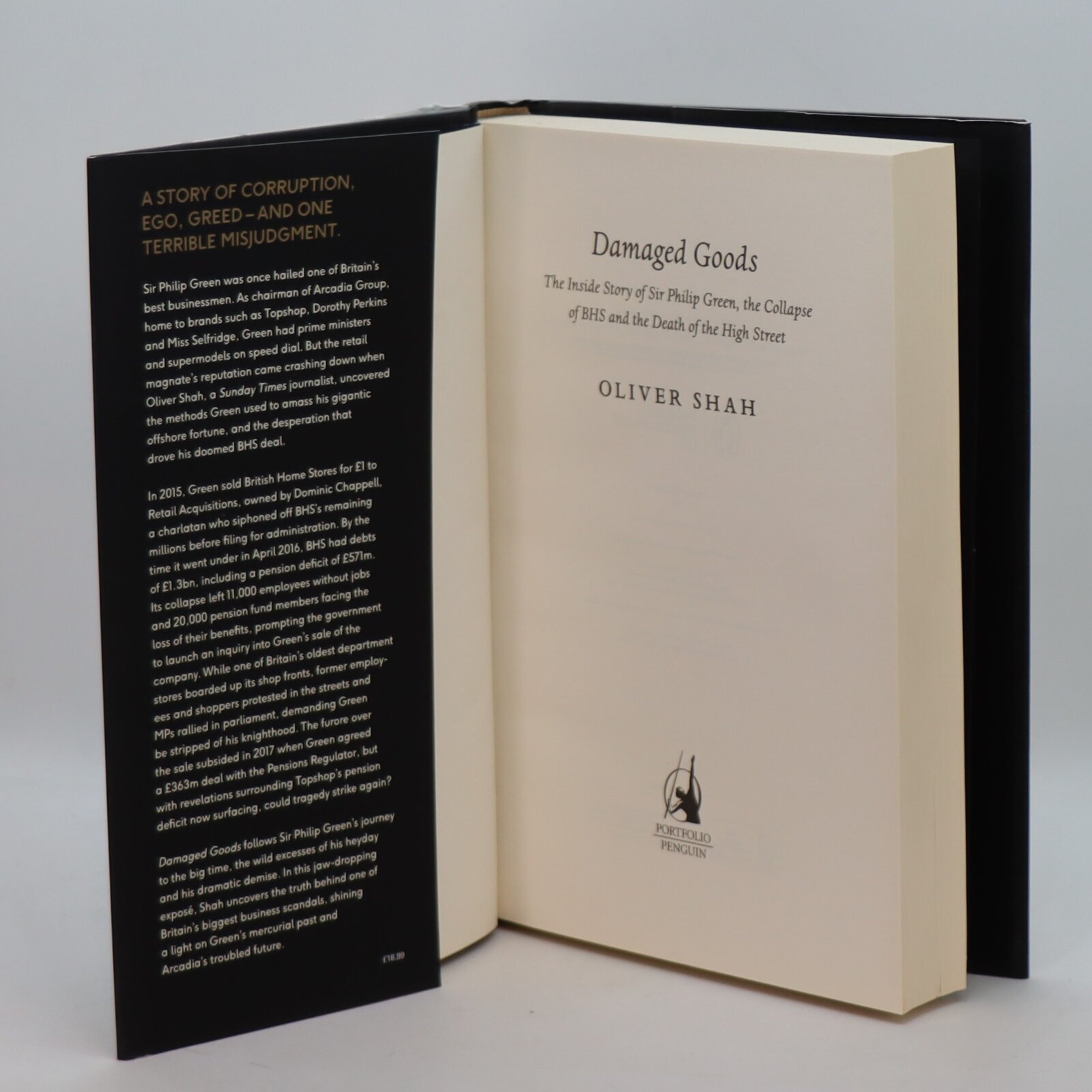

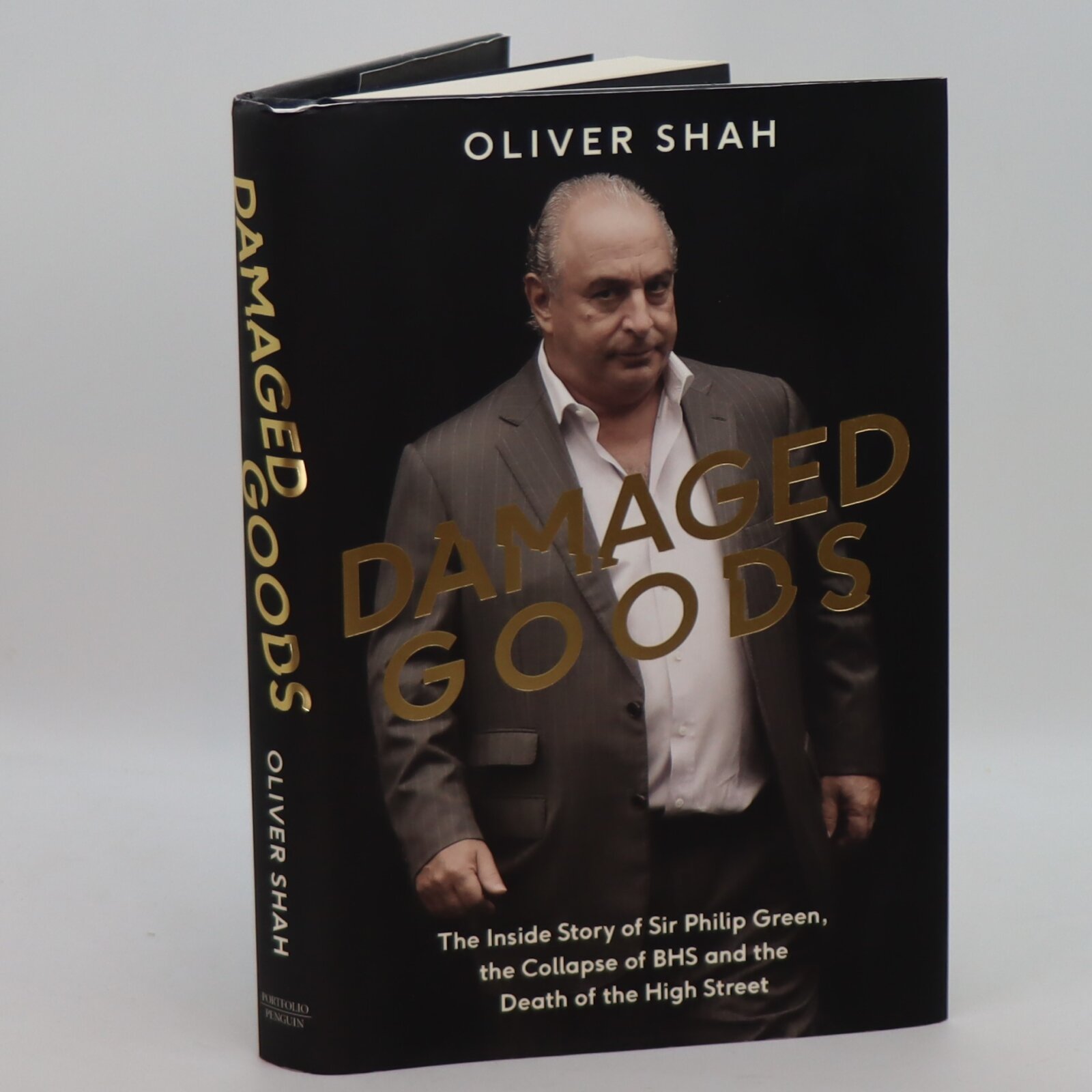

Damaged Goods.

By Oliver Shah

ISBN: 9780241341247

Printed: 2018

Publisher: Portfolio Penguin. London

| Dimensions | 17 × 25 × 4 cm |

|---|---|

| Language |

Language: English

Size (cminches): 17 x 25 x 4

Condition: Fine (See explanation of ratings)

Item information

Description

In the original dustsheet. Black board binding with gilt title on the spine.

F.B.A. provides an in-depth photographic presentation of this item to stimulate your feel and touch. More traditional book descriptions are immediately available

A STORY OF CORRUPTION, EGO, GREED – AND ONE TERRIBLE MISJUDGMENT. In this jaw-dropping expose, Oliver Shah uncovers the truth behind one of Britain’s biggest business scandals, following Sir Philip Green’s journey to the big time, the wild excesses of his heyday and his dramatic demise. Sir Philip Green was once hailed one of Britain’s best businessmen. As chairman of Arcadia Group, home to brands such as Topshop, Dorothy Perkins and Miss Selfridge, Green had prime ministers and supermodels on speed dial. But the retail magnate’s reputation came crashing down when Oliver Shah, a Sunday Times journalist, uncovered the methods Green used to amass his gigantic offshore fortune, and the desperation that drove his doomed BHS deal. In 2015, Green sold British Home Stores for £1 to Retail Acquisitions, owned by Dominic Chappell, a charlatan who siphoned off BHS’s remaining millions before filing for administration. By the time it went under in April 2016, BHS had debts of £1.3bn, including a pension deficit of £571m. Its collapse left 11,000 employees without jobs and 20,000 pension fund members facing the loss of their benefits, prompting the government to launch an inquiry into Green’s sale of the company. While one of Britain’s oldest department stores boarded up its shop fronts, former employees and shoppers protested in the streets and MPs rallied in parliament, demanding Green be stripped of his knighthood. The furore over the sale subsided in 2017 when Green agreed a £363m deal with the Pensions Regulator, but with revelations surrounding Topshop’s pension deficit now surfacing, could tragedy strike again?

NOTE: This is a bit of a hatchet job. The truth is that the last dividend paid from BHS to Philip Green was in 2004. The pension fund problems only emerged in 2008, and were caused by government policy to reduce interest rates to nearly 0, and hence ballooned pension scheme liabilities across the board. Nonetheless this is a fascinating book, and well researched, I couldn’t put it down! It needs to be made into a film.

Want to know more about this item?

Related products

Share this Page with a friend